UK’s Gambling Firms Warn They’ll Push Tax Hikes Onto Customers

Summary

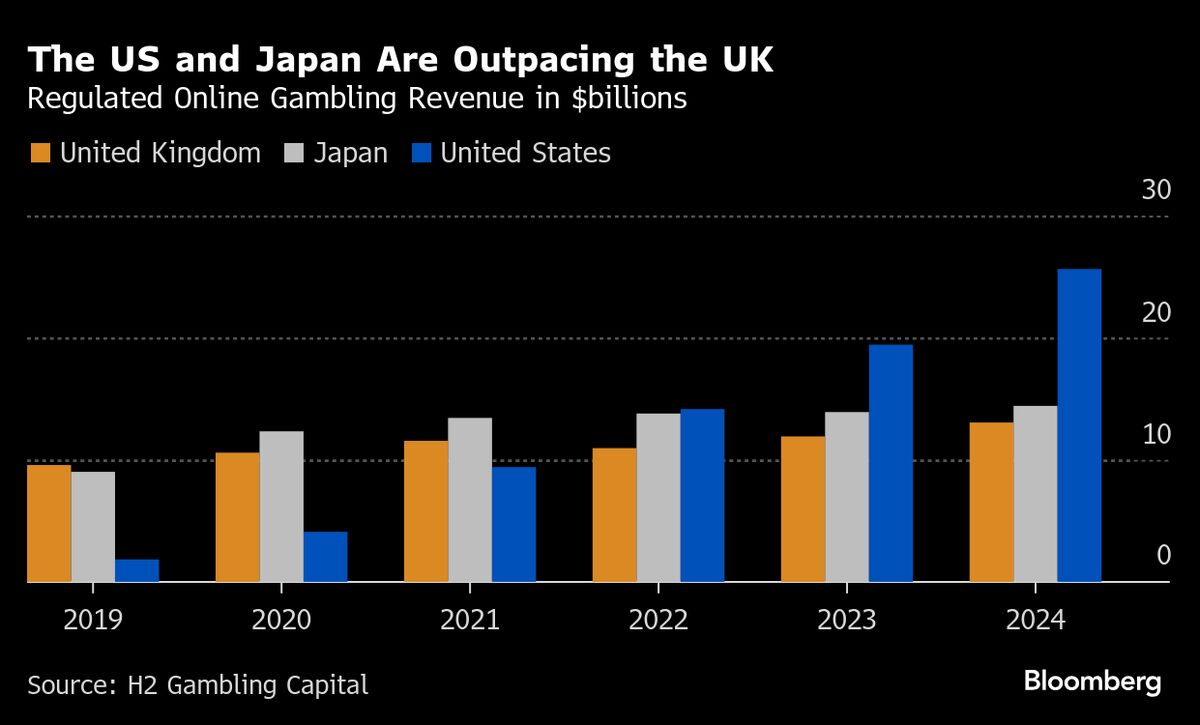

Gambling firms caution that potential tax increases from Chancellor Rachel Reeves could lead to shop closures and job cuts. Additionally, bettors may face worse odds, further tipping the scales in favor of the house.

Key Insights

How would proposed tax increases on gambling firms affect customers?

Gambling firms warn that tax hikes proposed by Chancellor Rachel Reeves could lead to shop closures and job cuts. To maintain profits, firms may pass on the increased costs to customers by offering worse betting odds, effectively making gambling more expensive and less favorable for bettors.

Sources:

[1]

What types of taxes are currently levied on gambling firms in the UK?

Betting and gaming duties in the UK are levied on operators’ gross profits or total stakes, depending on the gambling regime. Recent measures include a 25% higher tax rate on fixed-odds betting terminals and an increase in remote gaming duty from 15% to 21% of gaming providers’ profits. These taxes collectively raise billions in revenue annually.

Sources:

[1]