Uncertainty Driving Private Credit Jitters: Cisar

Summary

Winnie Cisar, CreditSights' global head of credit strategy, highlights rising private credit anxiety due to lower return expectations and economic uncertainties. Her insights follow Blue Owl Capital's decision to limit withdrawals from a retail-focused private credit fund.

Key Insights

What is private credit and why are investors becoming anxious about it in 2026?

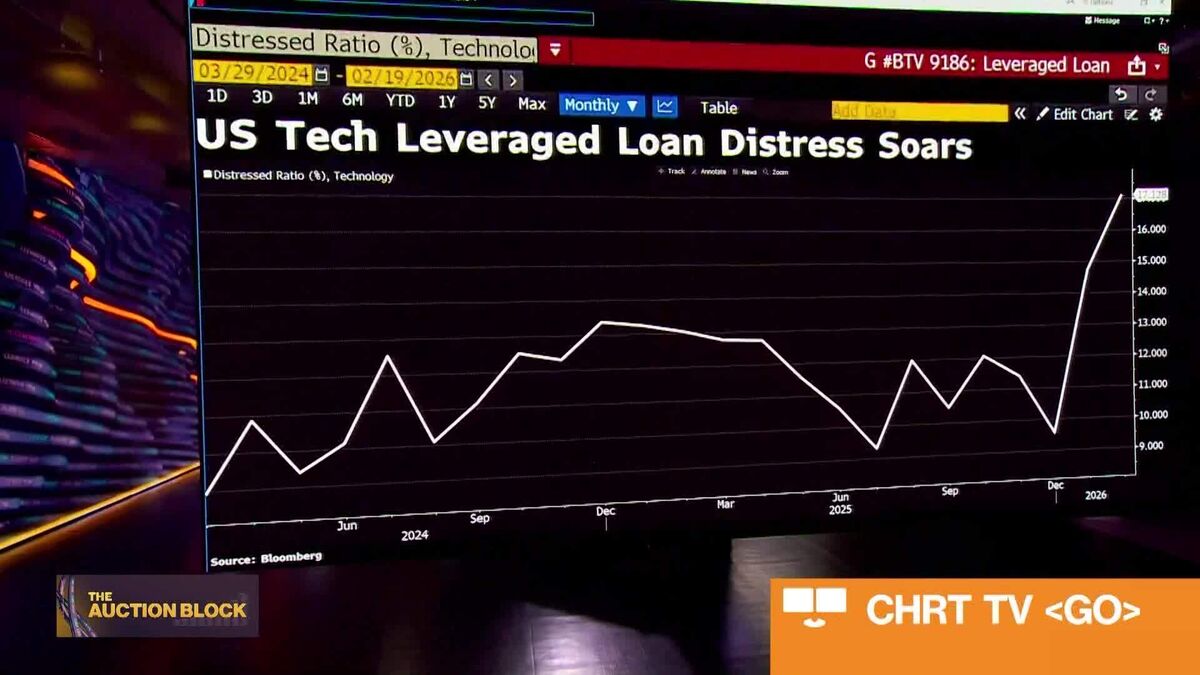

Private credit refers to debt financing provided directly by non-bank lenders to companies, typically outside of traditional bank lending channels. Investors are becoming anxious in 2026 due to several converging factors: private credit is facing its most challenging environment since the 2008 financial crisis, with global economic uncertainty around trade policy, concerns about excessive spending on artificial intelligence, and emerging signs of stress in corporate credit markets. High-profile leveraged loan defaults in late 2025 and rising use of payment-in-kind (PIK) toggles in direct lending indicate mounting borrower stress. Additionally, while headline default rates in private credit have remained below 2%, the 'true' default rate when accounting for selective defaults and liability management exercises approaches 5%, raising concerns about whether the asset class's historical performance will prove sustainable.

Why did Blue Owl Capital limit withdrawals from its retail-focused private credit fund, and what does this signal about the market?

While the search results do not contain specific details about Blue Owl Capital's withdrawal restrictions, the broader context reveals that private credit funds are facing liquidity pressures and exit challenges. Private credit is experiencing a difficult exit environment that is pressuring private equity managers to return capital to investors. Additionally, retail investors have gained significant access to private credit for the first time, with semi-liquid vehicles for the wealth channel now commanding almost a third of the $1 trillion US direct lending market. US retail allocation to private credit is projected to grow at an annualized rate of nearly 80% to reach $2.4 trillion by 2030. Withdrawal restrictions typically signal that fund managers are managing liquidity constraints or protecting remaining investors from forced asset sales during volatile market conditions, which aligns with the broader market stress and uncertainty characterizing 2026.