Markets

Recent Articles

Sort Options:

Bitcoin Zooms to $120K, ETH Nears $4K as Trump’s EU Tariff Deal Lifts Risk Sentiment

Markets surged as President Trump announced a tariff deal with the EU, reducing levies to 15%. This optimism boosted S&P 500 futures and Bitcoin, nearing $120,000. Experts highlight a structural shift in crypto investing amid rising institutional interest.

Polymarket set to reenter US with $112M acquisition of QCEX derivatives exchange

Polymarket reenters the U.S. market over two years after regulatory investigations were dropped, signaling a renewed interest in prediction markets. This comeback highlights the evolving landscape of online betting and market forecasting in the United States.

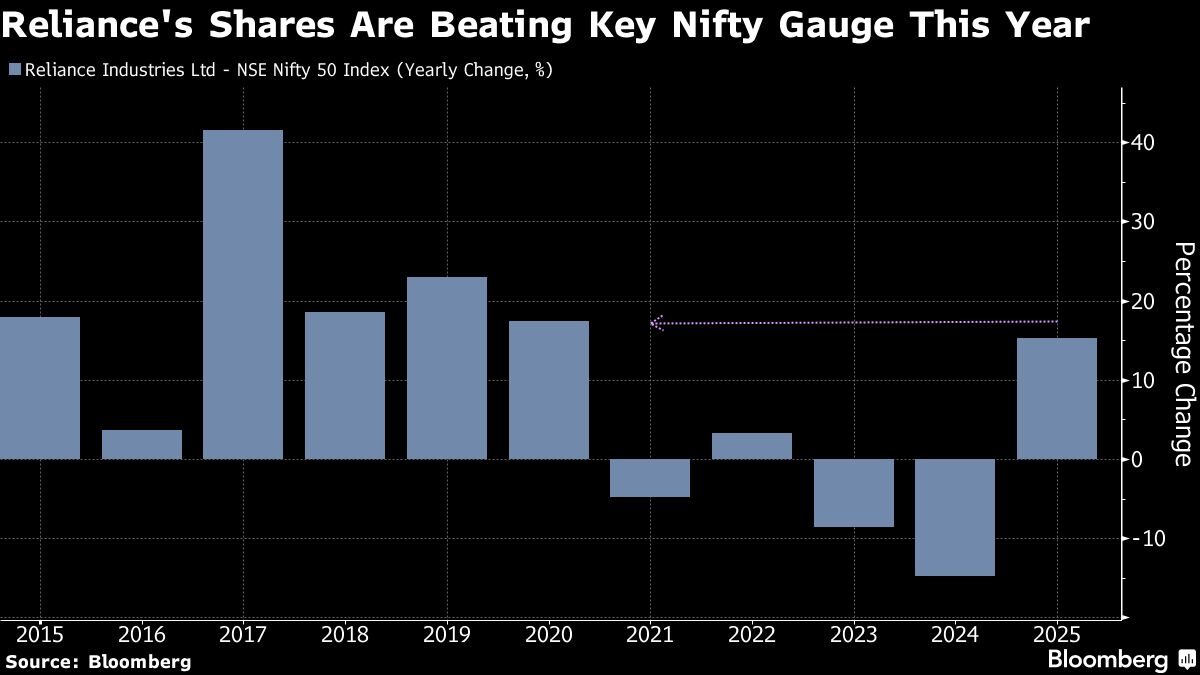

Indian Markets May Continue Weekly Loss on Tepid Axis Bank, Wipro Earnings

Before the trading day begins, the publication highlights essential news and events poised to influence market movements. Stay informed with this digest to navigate the financial landscape effectively and make strategic investment decisions.

Crypto Markets Bifurcate With Institutions Focusing on BTC and ETH While Retail Chases Alts: Wintermute

The crypto market is diverging, with institutional investors favoring Bitcoin and Ethereum, while retail traders shift towards altcoins and memecoins. Wintermute's report highlights this trend, indicating a more mature and specialized market landscape.

The End of the Stock Market As We Know It

Startups and major Wall Street firms are competing to tokenize stocks, bonds, and real estate, transforming traditional investments into crypto-like assets. The publication explores the implications of this trend for investors and their financial strategies.

Trumpet

Recent discussions highlight how former President Trump's actions significantly influence market movements. Analysts emphasize the importance of monitoring his statements and activities, as they can lead to immediate fluctuations in stock prices and investor sentiment.

Kalshi closes $185M round as rival Polymarket reportedly seeks $200M

Investors are significantly increasing their stakes in two competing prediction markets, highlighting a growing interest in alternative investment opportunities. This trend reflects a broader shift towards innovative financial platforms that engage users in forecasting outcomes.

The Next Frontier in Finance: Tokenized Access to Private Markets

Tokenization is revolutionizing private markets by enhancing accessibility and liquidity through blockchain technology. This shift allows smaller investors to engage with previously exclusive assets, signaling a move towards a more inclusive and transparent financial landscape.

Bitcoin, Dogecoin, Ether Could See Profit-Taking Even as Macro Conditions Improve

Bitcoin remains steady above $107,000, but signs of profit-taking emerge in the crypto market, with major tokens like Dogecoin and Tron experiencing losses. Experts highlight positive macroeconomic conditions and institutional interest as key drivers for ongoing market momentum.