Tech Business & Industry Moves / Earnings reports

Weekly Tech Business & Industry Moves / Earnings reports Insights

Stay ahead with our expertly curated weekly insights on the latest trends, developments, and news in Tech Business & Industry Moves - Earnings reports.

Recent Articles

Sort Options:

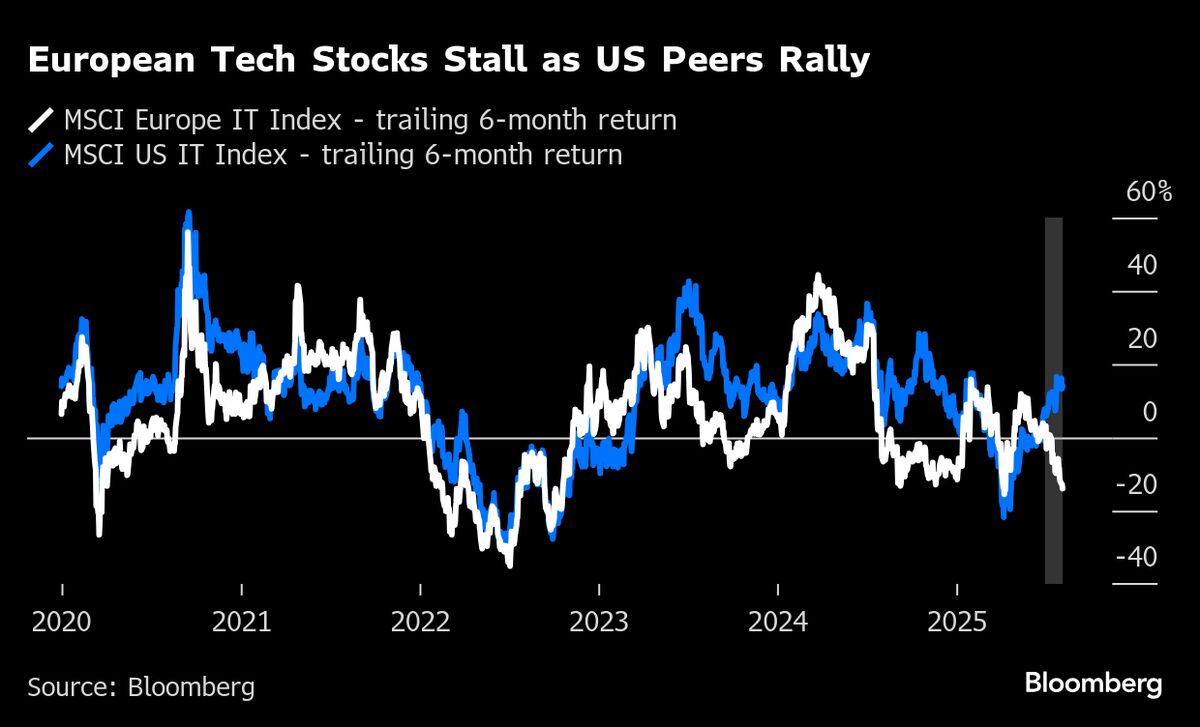

European Tech Stocks Miss Out on AI Frenzy as Earnings Falter

European technology stocks have significantly lagged behind US counterparts in the past six months, primarily due to weaker earnings momentum. This trend highlights the challenges faced by the European tech sector in a competitive global market.

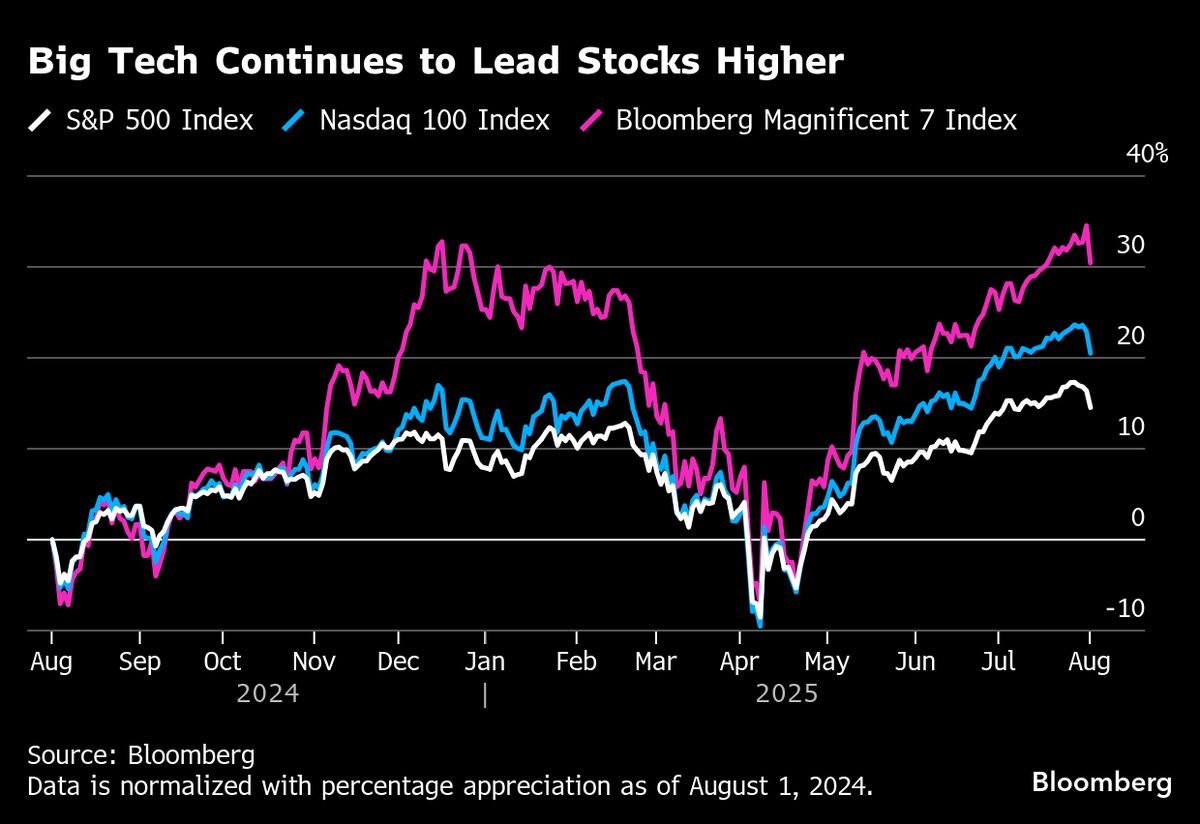

Big Tech Earnings Strength Is Bright Light in Murky Stock Market

This week’s big-tech earnings reports largely met Wall Street's high expectations, boosting investor confidence. The positive results from major companies signal a strong performance in the tech sector, highlighting its resilience in a fluctuating market.

Big Tech’s Big Earnings Week | Bloomberg Tech 8/1/2025

Bloomberg's Caroline Hyde and Ed Ludlow analyze Big Tech earnings and Trump's tariff changes impacting investors. Reddit COO Jen Wong shares insights on record profits, while Roblox CEO David Baszucki discusses user growth. SpaceX's Falcon 9 successfully launches to the ISS.

Apple’s Tim Cook Talks Trump Tariffs and AI

Tech giants, including Apple, unveiled their quarterly earnings this week, showcasing significant financial performances. Analysts highlight trends in revenue growth and market strategies, reflecting the evolving landscape of the technology sector and its impact on global markets.

Teradyne Robotics generates $75M in Q2

Teradyne Robotics reported $75 million in Q2 2025 revenue, a 9% increase from Q1 but a 17% decline year-over-year. Universal Robots led with $63 million, while challenges in the automation market persist, prompting strategic changes and workforce reductions.

Microsoft reports strong cloud earnings, with Windows and Xbox up too

Microsoft's Q4 2025 financial results reveal $76.4 billion in revenue and $27.2 billion in net income, driven by a 39% surge in Azure cloud services. Despite recent layoffs, overall gaming revenue rose 10%, highlighting a strategic shift in Xbox offerings.

TechCrunch Mobility: Tesla vs GM: A tale of two earnings

TechCrunch Mobility serves as a vital resource for the latest news and insights on the evolving landscape of transportation, keeping readers informed about innovations and trends shaping the future of mobility.

Apple, Meta, Amazon Face Mounting Tariff Pressures Amid AI Push: US Earnings Week Ahead

Next week, major companies like Apple, Amazon, and Microsoft will report on their strategies to tackle tariff-driven cost increases amid declining consumer confidence and rising demands for artificial intelligence investments, highlighting the challenges faced by blue-chip firms.

Netflix Shares Fall Despite Earnings Beat | Bloomberg Tech 7/18/2025

Bloomberg's Ed Ludlow analyzes Netflix's declining shares following earnings reports. Additionally, Taiwan Semiconductor Manufacturing's CFO outlines a $165 billion US expansion, while defense tech startup Hadrian secures $260 million in Series C funding led by Founders Fund.

India’s HCL Technologies, Tech Mahindra Lift Veil on IT Industry Outlook

HCL Technologies Ltd. and Tech Mahindra Ltd. are set to reveal insights into the future of the South Asian tech and software sector with their upcoming earnings reports next week, highlighting trends and developments in the industry.