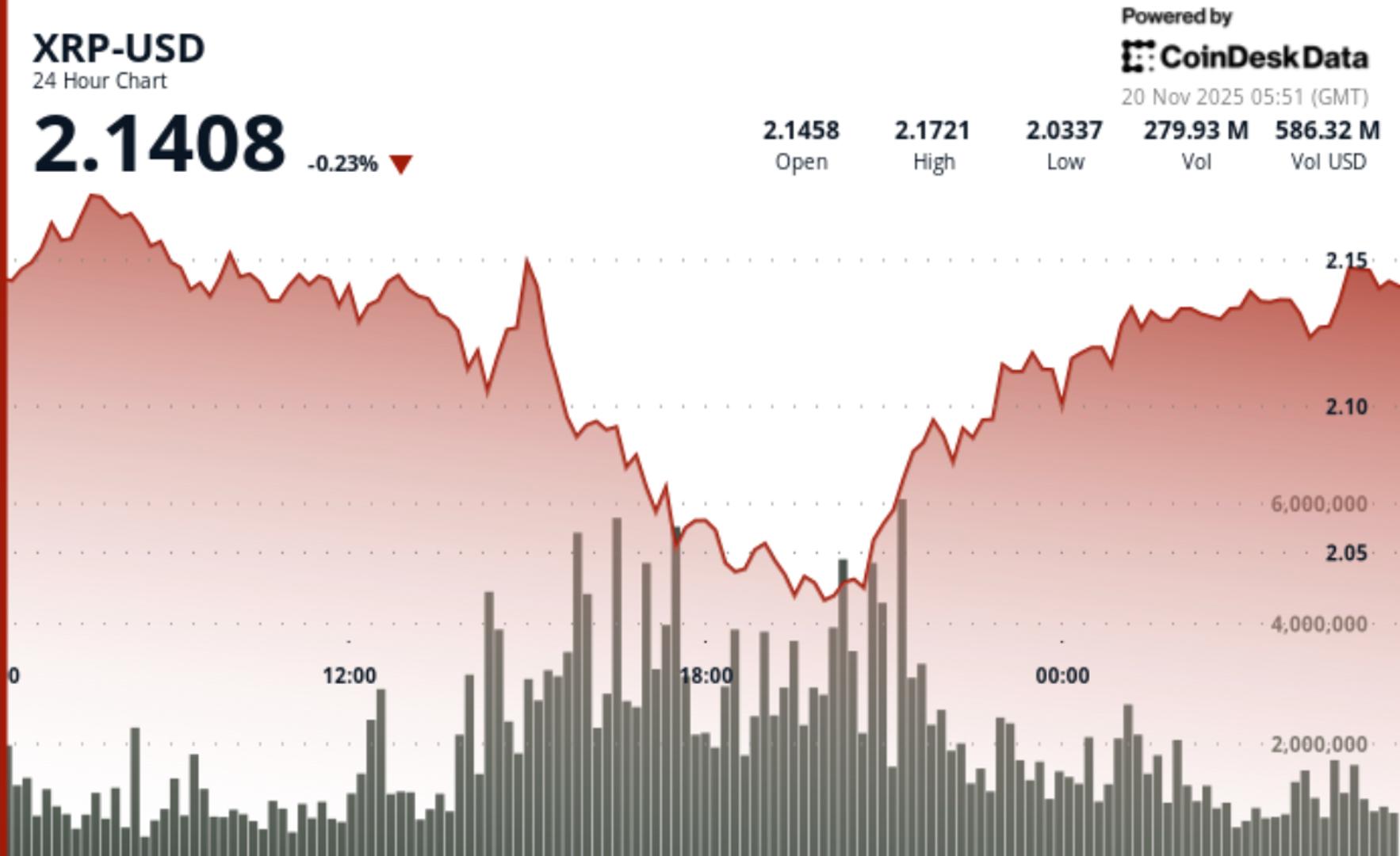

XRP Slumps as $2.15 Level Collapses, Bearish Structure Deepens

Summary

Broader crypto market weakness and Bitcoin's 'Death Cross' have led to a notable decline in XRP's value, highlighting the ongoing challenges within the cryptocurrency landscape. The authors analyze these factors impacting market dynamics.

Key Insights

What is a 'Death Cross' and how does it affect XRP's price?

A 'Death Cross' is a technical chart pattern where the 50-day moving average crosses below the 200-day moving average, signaling a potential long-term bearish trend. In the context of XRP, Bitcoin's recent Death Cross has contributed to broader market weakness and increased selling pressure on XRP, deepening its bearish momentum and causing its price to slump below key support levels like $2.15.

Sources:

[1]

Why is the $2.15 price level important for XRP?

The $2.15 level is a critical technical support point for XRP. Its collapse indicates a breakdown in bullish market structure, leading to increased bearish momentum. Traders watch this level closely because reclaiming it could neutralize immediate bearish bias, while failure to do so opens the door for further price declines. The $2.15 zone also aligns with supply clusters where selling pressure intensifies, making it a key battleground for price direction.

Sources:

[1]