Broad-based bitcoin accumulation emerges after sharp capitulation

Summary

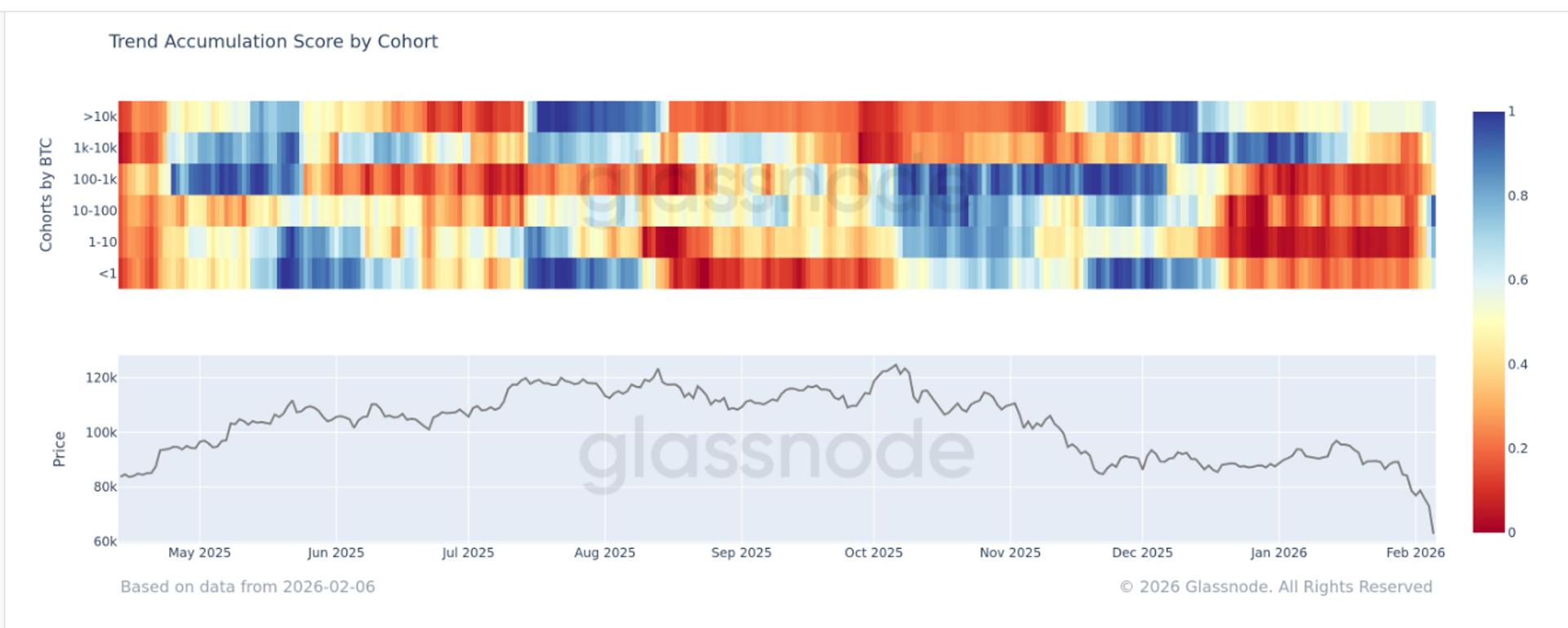

Recent Glassnode data reveals a surge in buying activity among all cohorts of Bitcoin holders, indicating a growing confidence in the cryptocurrency market. This trend highlights the increasing interest and potential for Bitcoin's future value.

Key Insights

What does 'sharp capitulation' mean in the context of Bitcoin?

Sharp capitulation refers to a rapid and intense sell-off where panicked investors sell their Bitcoin holdings at significant losses, often marking the end of a downtrend as weak hands exit the market. Glassnode data shows this occurring as Bitcoin price dropped from $98K to around $72K, with realized losses exceeding $1.2 billion per day and long liquidations surpassing $1 billion.

What is 'broad-based Bitcoin accumulation' and who is participating?

Broad-based accumulation means buying activity across various Bitcoin holder cohorts, particularly whales (holders of over 10,000 BTC) increasing positions while retail investors (under 10 BTC) sell. Glassnode reports early accumulation in the $70K–$80K range post-drop, with whale entities rising from 1,207 to 1,303 since October.