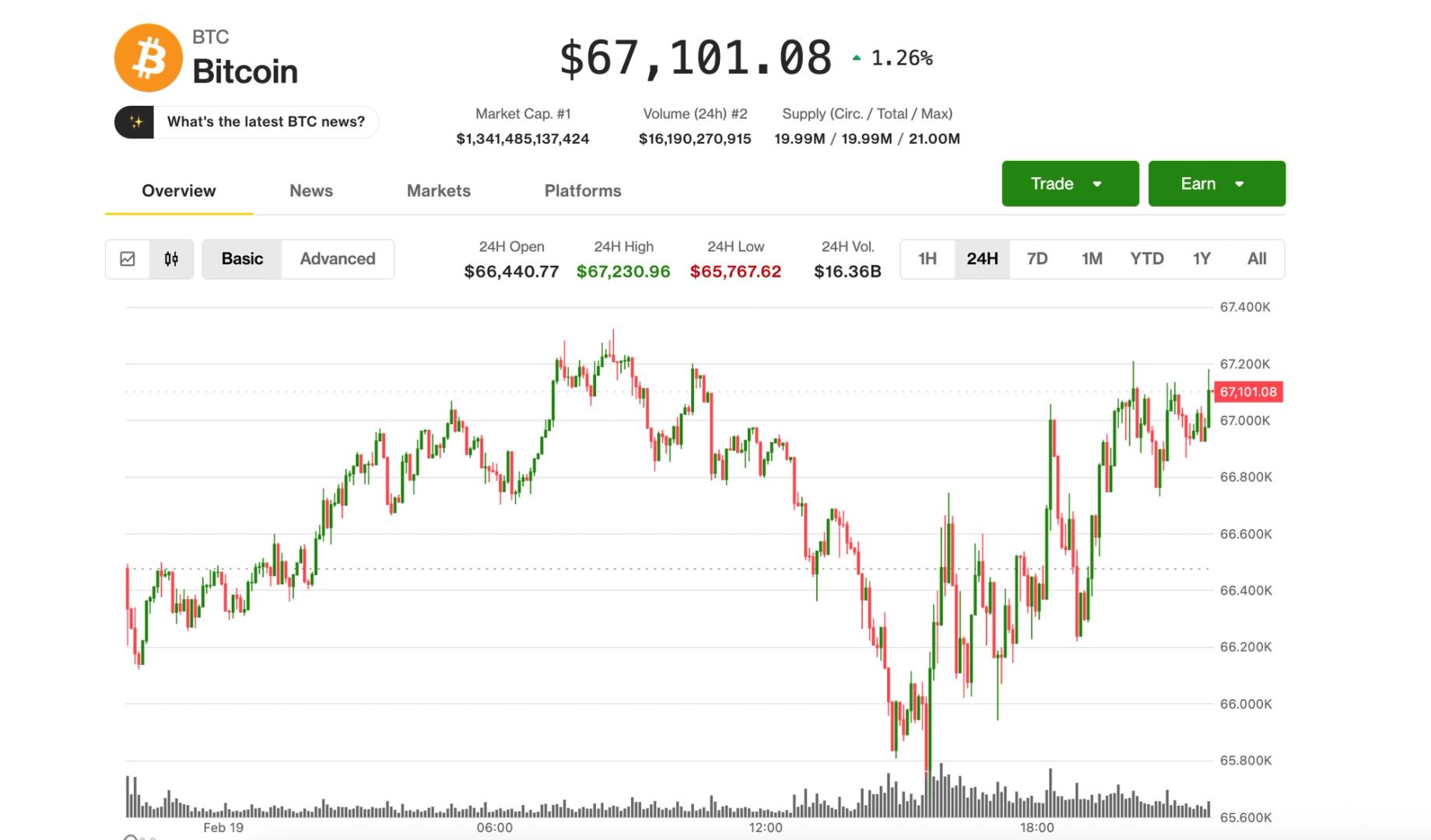

Bitcoin steadies near $67,000 as traders pay for crash protection

Summary

A Wintermute trader reports that the average Bitcoin ETF investor faces a 20% paper loss, raising concerns about potential capitulation selling if prices continue to decline. This situation highlights the volatility and risks associated with Bitcoin investments.

Key Insights

What does 'paying for crash protection' mean for Bitcoin traders?

Paying for crash protection refers to buying put options, which act as insurance against Bitcoin price drops. If the price falls below the option's strike price, the put allows selling at that higher price, offsetting losses, often at a cost of 8-12% premium.

What is a paper loss for Bitcoin ETF investors?

A paper loss is an unrealized loss on an investment that has decreased in value but has not been sold. For average Bitcoin ETF investors, this means a 20% decline in holding value without selling, potentially leading to capitulation selling if prices drop further.